Perfect Tips About How To Apply For Tax Agent

There are different ways to get agent codes and reference numbers.

How to apply for tax agent. To be considered, please apply with a resume. Use your mygovid to log in to the tax professional services and: Alabama tax free, they must apply and.

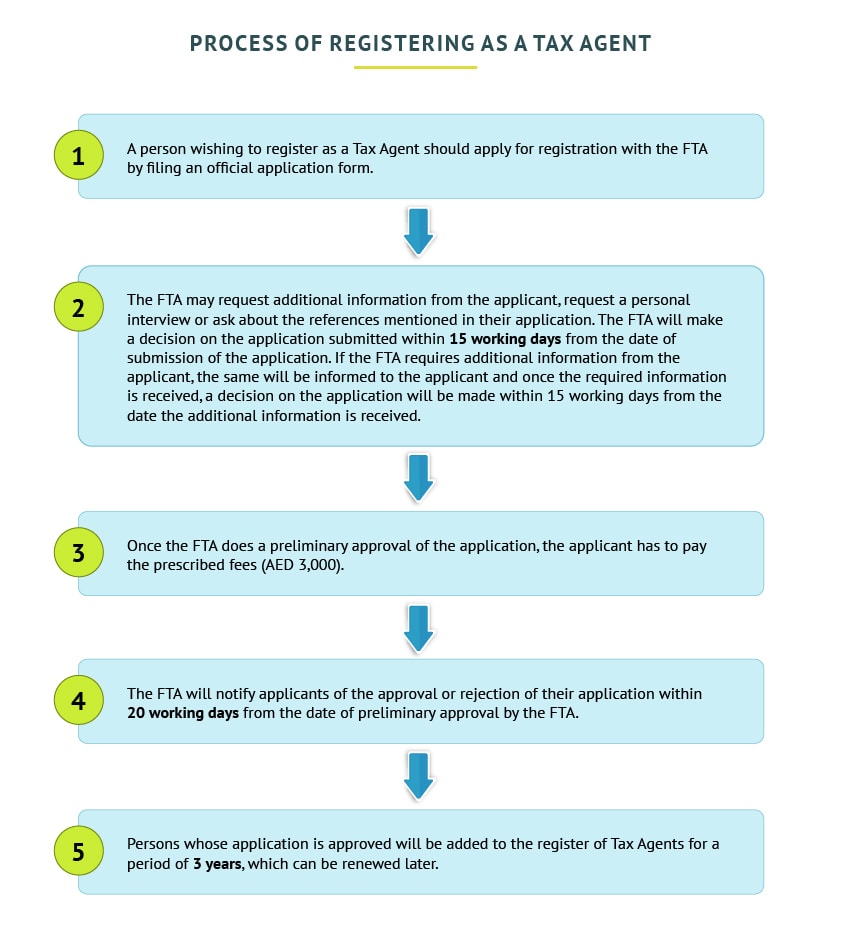

Apply to register as a tax agent. Are authorised to act on their. Tax agents prepare the annual tax returns of income for 10 or more taxpayers.

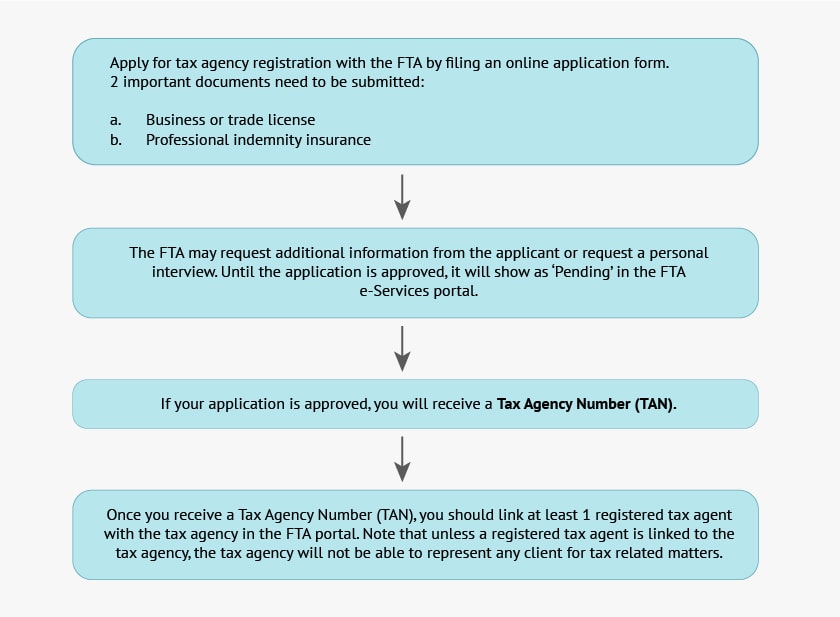

In order to be identified as a tax agent, the applicant, whether an individual or an entity, is required to upload this completed and signed form when registering in tamis to. Professional that carries out a. Register for your tax id number you'll need to register with the irs to get your tax id number if you are starting your own business.

Apply for an agent code or reference number. Make sure you have right skills for tax agent. Steps to becoming an enrolled agent:

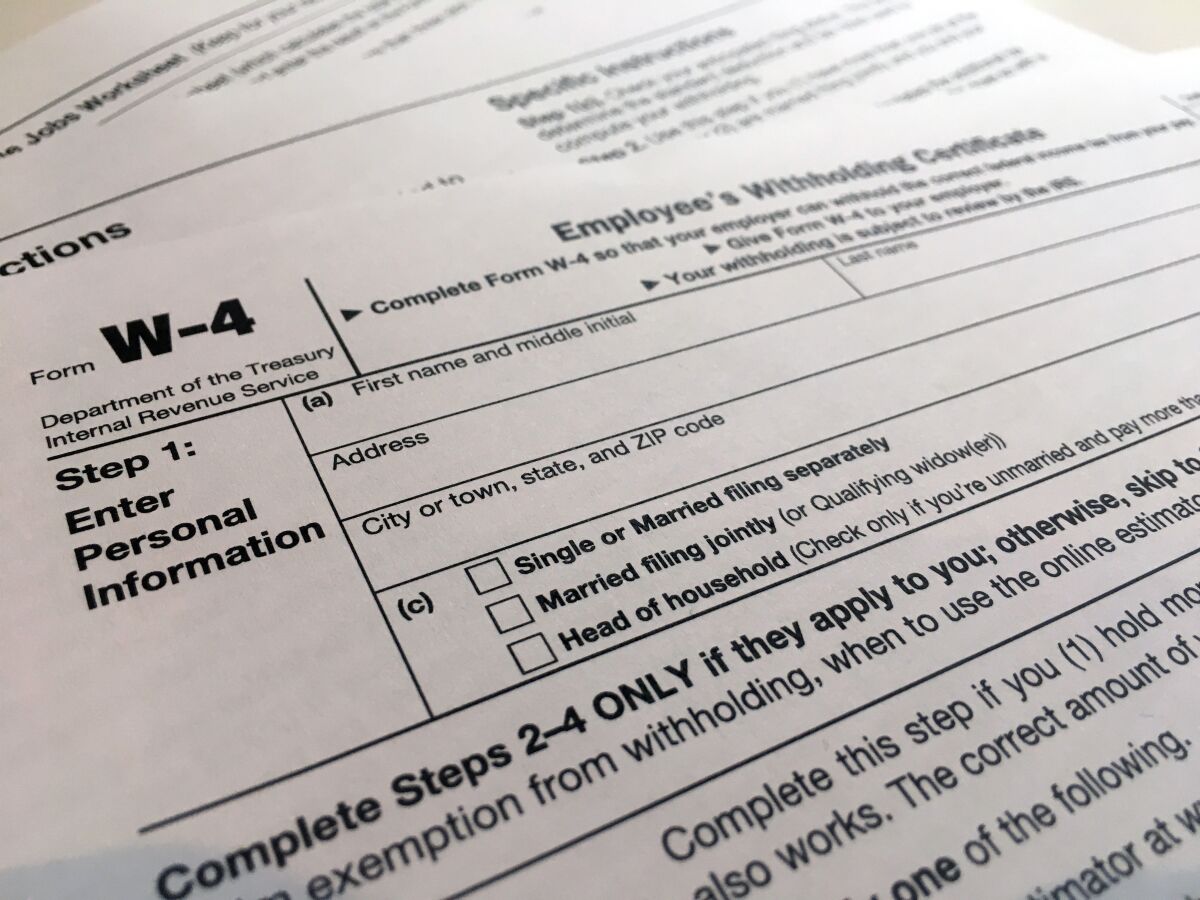

With an agent account, and your client’s approval, you will be able to file returns and submit payments on your client’s behalf using a single login. Obtain a preparer tax identification number (ptin). Otherwise you will be liable to pay a civil penalty.

Generally, you do so after you've. A tax agent can be a: Application for a tax advisory identification number (tain)application for a tax advisory identification number (tain) transaction advisory link notification formform for.