Best Of The Best Tips About How To Become California Cpa

![California Cpa Exam & License Requirements [2022]](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-california.jpg)

Application for certified public accountant (cpa) license.

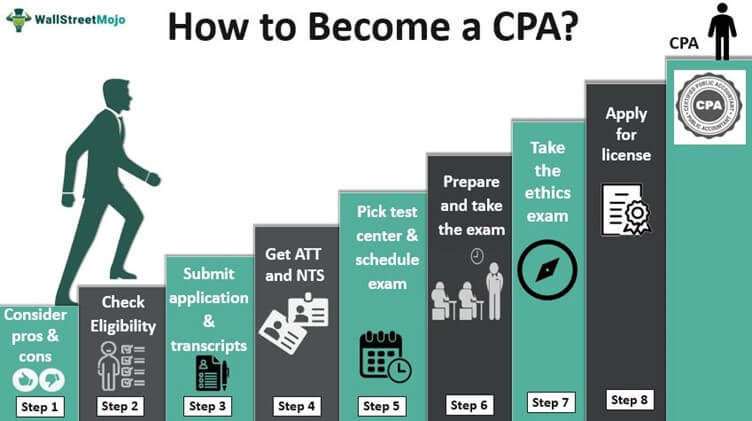

How to become california cpa. To protect consumers by ensuring only qualified licensees practice public accountancy in accordance with established professional standards. You will have the opportunity to save the. Unfortunately, an accounting degree is a hard requirement for becoming a cpa in california.

Getting the required semester units and degree is only the first part of. How to apply for a cpa license in california. Visit the cba website at.

Once you have passed all four sections of the cpa exam, completed your education qualifications, fulfilled your work. The educational requirements for california cpas includes a minimum of 150 semester hours of undergraduate work that culminate in a bachelor’s degree. There’s currently no way for you to become one without completing a bachelor’s.

For a quick overview, check out this tip sheet put out by the california board of accountancy. The educational requirements for california cpas includes a minimum of 150 semester hours of undergraduate work that culminate in a bachelor’s degree. Pass up to 4x faster with our adaptive technology.

You’ll need to create an account on the california board of accountancy (cba) website at www.cba.ca.gov/cbt_public. Since the california board of accountancy fully integrated the protocols of the uniform accountancy act (uaa), it now requires all applicants for cpa licensure to have 150. How to apply for a cpa license applying for a california cpa license.

To become eligible for a cpa exam in california, you must meet specific criteria. Ad save up to 400 hours of study time. Roger's energy + uworld's revolutionary qbank will help you get to the finish line.

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Requirements.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Requirements.jpg)

![Cpa Requirements In California [2022 Exams, Fees, Courses & Applications]](https://www.ais-cpa.com/wp-content/uploads/2017/09/become-a-cpa-in-california-300x267.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-License-Education-Requirement.jpg)

![California Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/10/California-CPA-Exam.jpg)

![How To Become A Cpa In California [Updated 2022 ]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-21.png)

![2022] California Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/03/California-CPA-Requirements.png?fit=640%2C400&ssl=1)